Lowe's Advantage Credit Card

Thinking about applying for the Lowe’s Advantage Card? If you want a card with rewards and advantages like 5% off* when you shop, or six months Special Financing** on purchases of $299 or more, or 84 fixed monthly payments with reduced APR† financing on purchases of $2,000 or more, a Lowe’s Advantage Credit Card may be right for you. View More >Home Depot Credit Card

The Home Depot Consumer Credit Card, issued by Citi, is a store credit card exclusively for Home Depot purchases. View More >Fortiva® Mastercard® Credit Card

The Fortiva Mastercard is geared toward people with poor credit scores who might not otherwise qualify for a credit card. View More >Home Depot Credit Card Application

Home Depot Credit Card Application Online1.To get started, visit website at homedepot.com/applynow.2.Click on “Credit Services” at the top of the page.3.Scroll down to the Consumer Credit card area and click “Apply Now” to apply for Home Depot card4.Enter your first and last name, your email View More >Chase Freedom Unlimited® credit card

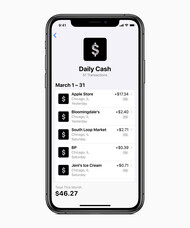

The Chase Freedom Unlimited® offers a compelling combination of easy-to-learn rewards, flexible redemption options, a solid sign-up bonus, and a lengthy 0% introductory APR period — all for an annual fee of $0. Although the card has done away with its splashy 3% introductory rewards rate, its other features still put it at the top of the class among 1.5% cash back cards. And if you carry other credit cards that earn Chase Ultimate Rewards® points, it packs even more value. View More >Best Buy credit card

Best Buy has 2 tiers of consumer credit cards: My Best Buy® Credit Card and My Best Buy® Visa® Card.Visa cardholders can utilize their card anywhere Visa is accepted. That means they have the opportunity to earn a percentage back on more spending, and they also have cash advance and balance transfer options. View More >Apply for Menards Credit Card

In fact, the entire application process takes around 10 minutes, so you won’t have to spend a lot of time on it. So, just follow our guidelines below and apply for this credit card.In the first place, you should open the website of this credit card: https://www.menards.com/main/credit-services/c-3 View More >How to apply for Fortiva Credit Card

Online at myfortiva.com/unsecured-credit-card/offer/First and the most used method is to apply online. In order to apply online for the card, follow these steps:• First of all, visit their official website or simply click the link given above• There, on the top center of the page, you will see a View More >Sams Credit Card >>

The Sam’s Club Credit Card, issued by Synchrony Bank, is a basic store credit card for Sam’s Club members with a less-than-stellar credit profile. The Sam’s Club Credit Card can only be used at Sam’s Club and Walmart stores and doesn’t offer any rewards on purchases, so it’s mainly for borrowers who aren’t likely to qualify for a better credit card that can be used more broadly. If your credit is just fair (if you have a FICO score of 580 to 669) and you shop at Sam’s Club and Walmart frequently, this card can be a worthwhile financing tool, albeit with a steep interest rate.

Sams Credit Card

The Sam’s Club Credit Card, issued by Synchrony Bank, is a basic store credit card for Sam’s Club members with a less-than-stellar credit profile. The Sam’s Club Credit Card can only be used at Sam’s Club and Walmart stores and doesn’t offer any rewards on purchases, so it’s mainly for borrowers who aren’t likely to qualify for a better credit card that can be used more broadly. If your credit is just fair (if you have a FICO score of 580 to 669) and you shop at Sam’s Club and Walmart frequently, this card can be a worthwhile financing tool, albeit with a steep interest rate.Sam's Club Mastercard Review

Card detailsEarn 5% cash back on gas (on first $6,000 per year in purchases, then 1%)Earn 3% cash back on dining and travelEarn 1% on other purchases.No annual feeNo foreign transaction feesDoubles as your membership cardRates, fees & offersAnnual fee:$0Rewards rate:1%-5%Bonus offer:Get $45 as aHow to apply for Sam's Club® Credit Card

Before you apply for the card, you need to have a SamsClub.com membership. Once you do:Locate the Sam's Club® Credit Card on the website.Click Apply now.Sign in to your account or register for an account with your membership number and zip code.Fill out the application form.Review the form andBig Lots Credit Card >>

The Big Lots Credit Card is a good choice for frequent Big Lots shoppers who want the flexibility to pay for their purchases over time. If you can handle the deferred-interest financing deals properly, you can save a lot of money and gain the flexibility around paying your credit card bill. Most people, however, will be better off with a cash-back card that works anywhere and earns rewards of some kind. Try the CardCruncher tool to find the right card for you.

Basic Informtion of Big Lots Credit Card

The Big Lots Credit Card is the most convenient way to pay for the crazy good deals you find every day at Big Lots.Big Lots Credit Card Payment

Online Credit Card Bill PaymentStep1: Login your account and navigate to the “my account” tab.Step2: Get the payment tab, choose a payment medium and make the payment for Big Lots Credit Card Bills.Payment through PCPC facility is a new service established by the Big Lots Credit Card Company. TyApply For BigLots Credit Card Online

If you are a regular shopper from Big Lots, it a fabulous opportunity for them to apply for a credit card. Big Lots credit cards are offered by the Comenity Capital Bank. With Big Lots credit card you can pay faster without sign in to your account. At the time of checkout, you may be offered a deferSurge Mastercard Credit Card >>

The Surge Mastercard® is one of the easiest credit cards to get if you have bad credit, but the card's annual and monthly fees may reduce its appeal. If you're considering the Surge Mastercard® to build credit, here's what you need to know before you submit your application.

How to Apply For Surge Mastercard® Credit Card

You may apply for a Surge credit card online from the websiteCall 1-866-513-4598 Return the acceptance certificate from the pre-selected offer that you received in the mail. To apply for a credit card online, over the phone, or through the mail some basic information will be required.the Rewards of Surge Mastercard® Credit Card

RewardsAll credit types welcome to applyFree access to your Vantage 3.0 score from TransUnion* (When you sign up for e-statements)Monthly reporting to the three major credit bureausFast and easy application process; results in secondsUse your card at locations everywhere Mastercard® is acceptedChecSurge Mastercard® Credit Card Payment

You can submit a Surge credit card payment from your account online. Or, you can pay your Surge credit card bill by phone, at 1-800-518-6142. Phone payments can be made from 7 am to 10 pm ET Mon–Fri, and 8 am to 4 pm on Saturday.Surge card payments can also be sent by mail. Mail a check, along witMenards BIG Credit Card >>

Menards has been one of the leading stores for home improvements for over five decades now. Many people rely on this store for their home improvement needs where they spend thousands of dollars. The Menards Big Card is designed to help all the Menards loyalists to get more rewards from making their purchases in the store and a few other selected gas stations. The card offers different types of rewards from cash back to in-store financing making it a very valuable tool especially if you tend to do a lot of home improvement.

Apply for Menards Credit Card

In fact, the entire application process takes around 10 minutes, so you won’t have to spend a lot of time on it. So, just follow our guidelines below and apply for this credit card.In the first place, you should open the website of this credit card: https://www.menards.com/main/credit-services/c-3Menards BIG Credit Card

Menards has been one of the leading stores for home improvements for over five decades now. Many people rely on this store for their home improvement needs where they spend thousands of dollars. The Menards Big Card is designed to help all the Menards loyalists to get more rewards from making their purchases in the store and a few other selected gas stations. The card offers different types of rewards from cash back to in-store financing making it a very valuable tool especially if you tend to do a lot of home improvement.How to Get the Most Out of Menards Big Card

HowBecause of the card’s high APR, opt for deferred-interest financing over the everyday rebate if you’ll need more than a month to pay off a purchase.That being said, beware of deferred interest associated with the card’s special financing offers. Interest is imposed retroactively if you stilStein Mart Credit Card >>

The Stein Mart Platinum Mastercard® offers additional savings on items that fly off the rack at the discount retailer's store.The card, issued by Synchrony Bank, earns rewards at the retailer online and in-store and everywhere that Mastercard is accepted. It also offers perks such as exclusive savings events, birthday surprises and the chance to earn even more rewards with Elite status. The card's annual fee is $0.

How to Apply For Stein Mart Credit Card

OnlineVisit the Stein Mart Credit Card website.Fill in the application form. You will typically need to provide general financial information, such as your Social Security Number, address, and annual income.Check the information is accurate and submit your application.If you're denied click hereStein Mart Credit Card

This Stein Mart credit card review uncovers the benefits, features, advantages and drawbacks of this store card. In this article, you will find out about the both SteinMart credit cards (including Platinum credit card), their fees, APR, features, and required credit. At the end of this page, you can leave your own reviews about this store branded credit card from Synchrony Bank.Stein Mart Credit Card Review

Full Review10% off your first purchase. It's certainly not the biggest first-purchase discount available from a retailer-affiliated credit card. But the 10% that you'll save on the first Stein Mart purchase that you make with the Stein Mart Card can still save you a bundle. And if you’re gMerrick Bank Credit Card >>

Merrick Bank, for those of you who aren’t familiar with the institution, is an online lender headquartered in Utah that specializes in credit cards and boat/RV financing. That’s interesting enough, but the Merrick Bank Secured Visa Card doesn’t offer much to hold your attention. Don’t get us wrong; it’s not a bad card. It’s just a no-frills, moderately priced option with competitors that are both cheaper and more exciting.

Merrick Bank Credit Card

Merrick Bank, for those of you who aren’t familiar with the institution, is an online lender headquartered in Utah that specializes in credit cards and boat/RV financing. That’s interesting enough, but the Merrick Bank Secured Visa Card doesn’t offer much to hold your attention. Don’t get us wrong; it’s not a bad card. It’s just a no-frills, moderately priced option with competitors that are both cheaper and more exciting.Is Merrick Bank Secured Visa Credit Card worth it for you?

The Merrick Bank Secured Visa card can be an option worth considering for those who have limited credit history or bad credit scores (between 300 and 579) since this card has no minimum credit score requirement. The security deposit provides security to the card issuer, allowing you to rebuild yourHow to Apply For Merrick Bank Credit Card

Apply onlinesearch the MerrickBank websiteOn the MerrickBank.com home page, click the "Enroll" link located on the top, right hand side of the navigation menu. You may also enroll by clicking the "Not Enrolled" link located under the Cardholder Center login.Gymboree® Credit Card >>

Gymboree Credit Card has no annual fee.This is a great option for people looking for a low-maintenance rewards card. It gives you rewards on your purchases, but you don't have to pay an annual fee for the privilege. If your credit is not great you could add a cosigner to improve your approval chances.

Gymboree Credit Card

Gymboree Credit Card has no annual fee.This is a great option for people looking for a low-maintenance rewards card. It gives you rewards on your purchases, but you don't have to pay an annual fee for the privilege. If your credit is not great you could add a cosigner to improve your approval chances.Gymboree Credit Card Review

Full ReviewSignup bonus. Offers a signup bonus of $10.Competitive APRs. US Bank Gymboree Visa Credit Card has a variable purchase APR that ranges from 15.49% up to 24.49%.No annual fee. This is a great option for people looking for a low-maintenance rewards card. It gives you rewards on your purchasGymboree Credit Card Payment

OnlineSearch the offical website of The US Bank and find out Gymboree Credit CardLog in to your account Select the "Bill Payments" tab, then "Pay My Account"Choose the account you are paying from and the frequency Complete the remaining payment information and seleOld Navy Credit Card >>

Old Navy is an American clothing and accessories retailing company owned by American multinational corporation Gap Inc. It has corporate operations in the Mission Bay neighborhood of San Francisco, California. The largest of the Old Navy stores are its flagship stores, located in New York City, Seattle, Chicago, San Francisco, Manila, and Mexico City.

Old Navy Credit Card

The Old Navy credit card offers rewards and unique perks for shoppers who frequent Gap Inc. Brands. If you buy most of your family's clothes from Old Navy and its sister brands, the Old Navy credit card might be for you.How to Apply For The Old Navy Credit Card

OnlineYou can apply for an Old Navy credit card online in a few minutes. Once approved, you'll receive a discount code for your first purchase that can be used for online or in-store items. Follow these steps to complete an Old Navy credit card application from your PC or mobile device.Fill outThe Old Navy Credit Card Review

Details of prosNice rewards on store purchases: Earning 5 points per $1 on every purchase you make at Old Navy and its sister stores equates to a 5% discount on future store purchases. That’s as good or better than you’ll find on other store credit cards. 30% discount on your first Old NavyPep Boys Credit Card >>

Pep Boys Credit Card is a store credit card issued by Synchrony Bank.New cardholders receive an introductory 0% APR rate on new purchases for up to 12 months.This is a great option for people looking for a low-maintenance card. It gives you the benefits of a credit card, but you don't have to pay an annual fee for the privilege.

Pep Boys Credit Card

Pep Boys Credit Card is a store credit card issued by Synchrony Bank.New cardholders receive an introductory 0% APR rate on new purchases for up to 12 months.This is a great option for people looking for a low-maintenance card. It gives you the benefits of a credit card, but you don't have to pay an annual fee for the privilege.How to Apply For Pep Boys Credit Card

OnlineVisit the Pep Boys Credit Card website.Fill in the application form. You will typically need to provide general financial information, such as your Social Security Number, address, and annual income.Check the information is accurate and submit your application.Pep Boys Credit Card Payment

OnlineVisit the Pep Boys Credit Card website and log in to your account Select the "Bill Payments" tab, then "Pay My Account"Choose the account you are paying from and the frequency (either "Once" or "Recurring" to set up AutoPay).Complete the remaining pFirst Progress Credit Card >>

First Progress offers three secured credit cards for people who are new to credit or rebuilding their credit. These cards have the same application requirements and similar features, but offer a choice between a lower annual fee or lower interest rate. The Platinum Select Mastercard® Secured Credit Card is the middle option.

First Progress Platinum Select Mastercard® Secured Credit Card

First Progress offers three secured credit cards for people who are new to credit or rebuilding their credit. These cards have the same application requirements and similar features, but offer a choice between a lower annual fee or lower interest rate. The Platinum Select Mastercard® Secured Credit Card is the middle option.How to Get the Most Out of First Progress Platinum Select Mastercard® Secured Credit Card

Build or repair your credit.You can apply with no credit history and with no minimum credit score. As soon as you get your card and start spending responsibly, First Progress reports your activity to the three major credit agencies. By paying on time every month, you can potentially improve your creHow to Apply For First Progress Platinum Select Mastercard® Secured Credit Card

OnlineSearch for the official websiteFollow the requirement and entry the needed messages.Fortiva Credit Card >>

If you have bad credit or don’t have an established credit history, secured credit cards—which require a security deposit—are a common option. But with the Fortiva credit card, you can potentially qualify for an unsecured card without a security deposit, even if you have less-than-perfect credit. There are annual fees and account maintenance fees, but your payment history is reported to the major credit bureaus, which can help build your credit, and you can review your credit score online.

Fortiva® Mastercard® Credit Card

The Fortiva Mastercard is geared toward people with poor credit scores who might not otherwise qualify for a credit card.How to apply for Fortiva Credit Card

Online at myfortiva.com/unsecured-credit-card/offer/First and the most used method is to apply online. In order to apply online for the card, follow these steps:• First of all, visit their official website or simply click the link given above• There, on the top center of the page, you will see aFortiva credit card

If you have bad credit or don’t have an established credit history, secured credit cards—which require a security deposit—are a common option. But with the Fortiva credit card, you can potentially qualify for an unsecured card without a security deposit, even if you have less-than-perfect credit. There are annual fees and account maintenance fees, but your payment history is reported to the major credit bureaus, which can help build your credit, and you can review your credit score online.Woman Within Credit Card >>

Woman Within Credit Card Accounts are issued by Comenity Bank.It has no annual fee and no need to worry about annual charges! You can earn Rewards Every Time You Shop$10 Rewards for every 200 points earned at FULLBEAUTY Brands. 1 point earned for every $1 spent with your card.

Woman Within Credit Card

Woman Within Credit Card Accounts are issued by Comenity Bank.It has no annual fee and no need to worry about annual charges! You can earn Rewards Every Time You Shop$10 Rewards for every 200 points earned at FULLBEAUTY Brands. 1 point earned for every $1 spent with your card.How to Apply For Woman Within Credit Card

OnlineVisit the Woman Within Platinum Credit Card website.Fill in the application form. You will typically need to provide general financial information, such as your Social Security Number, address, and annual income.Check the information is accurate and submit your application.How to Get Most Out of Woman Within Credit Card

Choose to use this card to shop on your birthday monthYou will receive an exclusive offer for your orders placed during your birthday month.Earn reward points through shoppingYou could get 1 point for every $1 you spend on your card at any of the fullbeauty brands.These points can be redeemed for riAmazon Credit Card >>

The Amazon Credit Card is the best credit card for Amazon Prime members, as well as an excellent way to save for anyone with a 700+ credit score who likes to shop online. The Amazon Visa Card has a $0 annual fee and rewards users with 3% or 5% back on Amazon purchases (Prime members get the higher rate). Those earning rates are nearly 3- and 5-times the market average for a rewards card, respectively. You can learn more about this lucrative everyday rewards card below:

The Rewards of Amazon Credit Card

RewardsA $50 Amazon.com Gift Card ($70 for Prime members) will instantly be loaded into your Amazon.com account upon the approval of your credit card application.Earn 3 points for every $1 spent on Amazon.com and Whole Foods Market, 2 points for every eligible $1 spent at gas stations, restaurants aAmazo Prime Reward Visa Signature Card

Like many other retail cards, however, the Amazon Credit Build card can only be used for Amazon purchases, making it a “closed-loop” card.Amazon’s newest credit card is designed to appeal to consumers who are looking to improve their credit score. It comes with an unusual structure — and some major caveats.Amazon Credit Card Review

Full ReviewThe Amazon Credit Card is the best credit card for Amazon Prime members, as well as an excellent way to save for anyone with a 700+ credit score who likes to shop online. The Amazon Visa Card has a $0 annual fee and rewards users with 3% or 5% back on Amazon purchases (Prime members get tApplied Bank Credit Card >>

The Applied Bank Secured Visa Gold Preferred card is more expensive and offers fewer benefits than many of its competitors, but it can offer an opportunity to improve credit with responsible use. Purchase APR is relatively low when compared to other secured credit cards, but it's important to keep in mind that Applied Bank doesn't provide a grace period, which means purchases will start accumulating interest immediately. Even with the lower rate, you could end up paying more over time.

The Rewards of Applied Bank® Secured Visa® Gold Preferred® Credit Card

Currently, this card does not provide any rewards, but as a means of financing, it provides convenience to customers. If you are a loyal customer of this bank, then this card can provide you with new shopping methods and promptly notify you of special offers in the store.That can come in handy if yoHow to Get Most Out of Applied Bank® Secured Visa® Gold Preferred® Credit Card

The Applied Bank Secured Visa Gold Preferred card is more expensive and offers fewer benefits than many of its competitors, but it can offer an opportunity to improve credit with responsible use. Purchase APR is relatively low when compared to other secured credit cards, but it’s important to keepApplied Bank Secured Visa Gold Preferred Credit Card

Applied Bank guarantees approvals and doesn't run a credit check. There are several fees associated with this card, but the Secured Visa Gold Preferred card can still help those with damaged credit improve credit scores over time.BBVA Compass Bank Credit Card >>

BBVA is an FDIC insured brick-and-mortar bank with 649 branches in seven states. BBVA launched in 1964 in Birmingham, AL. The bank is now among the 25 largest banks based on commercial deposits, and is one of the largest banks in Alabama, Arizona, and Texas. This in-depth review of BBVA Bank can help you decide if the products and services are a good fit for you.

BBVA Compass ClearPoints Credit Card

For cardholders with excellent credit, the BBVA Compass ClearPoints card is more affordable than the average low interest rate card and offers a long introductory period on balance transfers and new purchases, though also a higher-than-average balance transfer fee.BBVA Compass ClearPoints Credit Card Review

Details of ProsNo Annual Fee. BBVA ClearPoints Credit Card has no annual fee. That's great news for frugal cardholders who don't spend heavily enough to offset any recurring charge. Given this card's low earning rate, it would take a considerable amount of spending to balance out even aThe Rewards of BBVA Compass ClearPoints Credit Card

RewardsLimited time offer - Get a $100 account credit when you make $1,500 in purchases in the first 90 days of account opening.Choose from a list of 10 predetermined categories to earn 3x unlimited points in one category and 2x unlimited points in another category.Category selections must be made eBealls Florida Credit Card >>

While today comprised of Bealls Florida and Bealls Outlet, the Bealls, Inc. company began in 1915 as a dry goods store in Bradenton, Florida. Dedicated to affordability, Robert Beall's original store was called The Dollar Limit and sold all of its merchandise for $1 or less. Today's Bealls department stores maintain the original spirit of thrift by offering discount and budget fashion to customers from its 500 nationwide locations.

Bealls Florida Credit Card

Similar to other multi-faceted brands, Bealls has two distinct credit card products for each of its main brands. The Bealls Florida Credit Card, which earns Coast2Coast Rewards, is usable at Bealls Florida locations. The Bealls Outlet Credit Card, which operates on the One Card loyalty program, can be used in Bealls Outlets nationwide.Bealls Florida Credit Card Review

Full ReviewAlthough some reviewers indicate the cards can be used to make purchases in either store type, the card's fine print does not state that this is the case, so your experience may vary. Whether they're interchangeable or not, however, the cards are extremely similar when it comes toHow to Apply For Bealls Florida Credit Card

OnlineVisit the Bealls Florida Credit Card website.Fill in the application form. You will typically need to provide general financial information, such as your Social Security Number, address, and annual income.Check the information is accurate and submit your application.If you're denied clickBlair Credit Card >>

The Blair Credit Card is a popular card in the market, provides a $10 rewards certificate for users able to make purchases of $150 plus, other bonus which comes to them when they manage their online account properly. Besides, this card is issued by the well known Comenity Capital Bank. Notable this article has in it the necessary information about the Blair Card.

How to Get the Most Out of Blair Credit Card

You can only use the Blair Credit Card at Comenity BanksYou can use the Blair Credit Card anywhere that Visa/Master is acceptedPay your balance on time.Avoid unnecessary interest and fees.If you have any question, you can contact the credit card's customer service.Blair Credit Card

Blair Credit Card is a store credit card issued by Comenity. If you're wondering whether Blair Credit Card is the right card for you, read on. This is everything you need to know to make a good choice.Blair Credit Card Review

Full ReviewThe Blair Credit Card is offered to shoppers of the Blair catalog & Blair online store. It can also be used at Blair's "sister" stores including Haband, Old Pueblo Traders, Bedford Fair, Willow Ridge and more.In addition to allowing you to buy on credit from the Blair caBlaze MasterCard Credit Card >>

The Blaze Mastercard is an unsecured credit card designed specifically for people working toward building their credit. After making six on-time monthly payments, cardholders can qualify for a credit line increase, but they will pay an annual fee and authorized user fee.The Blaze Mastercard bills itself as the "go-to card for people to start rebuilding their credit." If you want to repair your credit without resorting to a secured credit card, the Blaze Mastercard is a solid option.

Blaze MasterCard Credit Card

The Blaze Mastercard is an unsecured credit card designed specifically for people working toward building their credit. After making six on-time monthly payments, cardholders can qualify for a credit line increase, but they will pay an annual fee and authorized user fee.The Blaze Mastercard bills itself as the "go-to card for people to start rebuilding their credit." If you want to repair your credit without resorting to a secured credit card, the Blaze Mastercard is a solid option.How to Apply For Blaze MasterCard Credit Card

Check Your Credit ScoreThis step is optional, but it's a good idea to know your credit score before you apply. While the Blaze Mastercard is known for approving applicants with lower credit scores, it helps to know just where you stand before you submit your application.You can get your credit sWho Is Blaze MasterCard Credit Card Best For?

If you have no credit history or poor credit and don’t want a secured credit card, the Blaze Mastercard can be a good option. It gives you access to an unsecured line of credit, and you can qualify for an increased credit line in as little as six months. While it does charge fees, this card cChadwicks Credit Card >>

Women’s clothing retailer Chadwicks of Boston, in partnership with Comenity Bank, offers a credit card that allows you to earn rewards toward future Chadwicks purchases.If you are a frequent Chadwicks shopper and have excellent credit, you may want to take advantage of the rewards the Chadwicks credit card offers.

Chadwicks Credit Card

Women’s clothing retailer Chadwicks of Boston, in partnership with Comenity Bank, offers a credit card that allows you to earn rewards toward future Chadwicks purchases.If you are a frequent Chadwicks shopper and have excellent credit, you may want to take advantage of the rewards the Chadwicks credit card offers.Chadwicks Credit Card Review

Full Review5x the points on the Chadwicks Credit Card issued by Comenity Bank is not bad at all and at a 1 CPP value, it’s a decent option, however, there are some limitations I want to go over before ending the post. The card is limited to only purchases at Chadwicks of Boston. Redeeming rewardsHow to Get Most Out of Chadwicks Credit Card

If you are a frequent Chadwicks shopper and have excellent credit, you may want to take advantage of the rewards the Chadwicks credit card offers. You’ll get 10 points per dollar charged to the card, then for every 1000 points you earn (i.e., every $100 in card purchases) you’ll get a $10 rewardFirestone Complete Auto Care Credit Card >>

The Firestone Complete Auto Care Credit Card’s sole purpose is to help pay off large purchases over six months without accruing interest. But be warned, this is a deferred interest plan, rather than a 0% APR offer; if you miss a payment or pay late, you’ll be charged interest at a high rate, dating all the way back to when you first made the purchase.

How to Apply for Firestone Complete Auto Care Credit Card

Visit the Firestone Complete Auto Care Credit Card website.Fill in the application form. You will typically need to provide general financial information, such as your Social Security Number, address, and annual income.Check the information is accurate and submit your application.If you're denieFirestone Complete Auto Care Credit Card

The Firestone Complete Auto Care Credit Card’s sole purpose is to help pay off large purchases over six months without accruing interest. But be warned, this is a deferred interest plan, rather than a 0% APR offer; if you miss a payment or pay late, you’ll be charged interest at a high rate, dating all the way back to when you first made the purchase.Firestone Complete Auto Care Credit Card Review

Full ReviewThough primarily known today for its consumer automobile tires and service centers, the Firestone Tire and Rubber Company, founded in 1900, actually predates most car companies, having gotten its start supplying tires for wagons, buggies, and other forms of early wheeled transportation. TFootlocker Credit Card >>

Foot Locker Retail, Inc. is an American sportswear and footwear retailer, with its headquarters in Midtown Manhattan, New York City, and operating in 28 countries.According to the company's filings with the SEC, as of January 28, 2017, Foot Locker, Inc. had 3,363 primarily mall-based stores in the United States, Canada, Europe, and Asia. Nearly 70% of its product is from Nike.

How to Apply For Footlocker Crecit Card

Go to the website of the Foot Locker credit cardThen provide all the required personal information; Name, date of birth, postcode, gender, telephone number, mobile phone number, e-mail address, password, password confirmation.Then click on"Next" to continueEnter your e-mail address and verFootlocker Credit Card Payment

OnlineLog in to your accountAfter logging in, find the payment buttonClick on the payment tab and choose the payment method you want to use to pay the bills.Fred Meyer Credit Card >>

The Fred Meyer Rewards World Mastercard from U.S. Bank provides real savings on which fans of the Fred Meyer brand can rely. The card earns two points on every purchase (minus gas) at Fed Meyer or Kroger and a single point on everything else. 500 points equals $5 in free groceries, while 1,000 points equal up to $1.25 in savings one each gallon of gas pumped for a year. The card also offers 0% introductory APR and no annual fee.

How to Get the Most Out of Fred Meyer Rewards® World Mastercard

Purchases at Fred Meyer locationsSave up to $1.25 per gallon at Fred Meyer and Kroger Family of Companies Fuel CentersReceive a $5 Rewards Rebate to spend at Fred Meyer every time you earn 500 Reward PointsFred Meyer Rewards® World Mastercard

The Fred Meyer Rewards World Mastercard from U.S. Bank provides real savings on which fans of the Fred Meyer brand can rely. The card earns two points on every purchase (minus gas) at Fed Meyer or Kroger and a single point on everything else. 500 points equals $5 in free groceries, while 1,000 points equal up to $1.25 in savings one each gallon of gas pumped for a year. The card also offers 0% introductory APR and no annual fee.Fred Meyer Rewards® World Mastercard Review

Full ReviewThe Fred Meyers Rewards Mastercard is a no annual fee retail credit card co-branded between Kroger grocery brand Fred Meyer and major credit card issuer U.S. Bank. The card earns rewards for every purchase made, with cardholders earning double points (two points for every dollar spent) onGameStop Power Up Rewards Credit Card >>

GameStop Power Up Rewards Credit Card is a store rewards credit card issued by Comenity. If you're wondering whether GameStop Power Up Rewards Credit Card is the right card for you, read on. This is everything you need to know to make a good choice.

How to Apply For GameStop Power Up Rewards Credit Card

Visit the GameStop Power Up Rewards Credit Card website.Fill in the application form. You will typically need to provide general financial information, such as your Social Security Number, address, and annual income.Check the information is accurate and submit your application.If you're denied cGameStop Power Up Rewards Credit Card

GameStop Power Up Rewards Credit Card is a store rewards credit card issued by Comenity. If you're wondering whether GameStop Power Up Rewards Credit Card is the right card for you, read on. This is everything you need to know to make a good choice.GameStop Power Up Rewards Credit Card Review

Details of prosNo Annual Fee: Unless your main objective is credit building, the GameStop Credit Card is unlikely to be your only option. After all, you can only use it to make GameStop purchases, and we all have thousands of dollars in non-GameStop spending that we can put on plastic each year.As aHorizon's VISA Credit Card >>

Horizon Bank was founded in 1873 and its headquarters are located in Michigan City, Indiana. Horizon Bank owns assets totaling $4 billion and deposits totaling $3 billion, making it a large bank. Horizon Bank does not have the access to customer service other banks offer. It is a conventional brick-and-mortar bank, which means in-person service, in addition to its online and mobile presence. On the whole, Horizon Bank is a good bank that deserves your consideration at a rating of 4.1 stars out of 5 from the SmartAsset team.

Horizon Bank Visa Credit Card Payment

make a payment onlinesearch the official websiteclick "ONE TIME PAYMENT"or"ENROLL/LOGIN" to make a one time immediate payment/enroll in reoccurring payments using your checking or savings account,or to make a one time payment with your checking accountfollow the requirement and fHorizon Visa classical Credit Card Review

Card FeaturesNo annual feeCredit lines starting up to $5,0000% introductory rate for the first 12 months, after that variable APRs currently 13.75% to 18.75% on purchases and balance transfers*Can be linked to checking for overdraft protectionCompatible with Apple Pay® for convenient purchasesFraudThe Rewards of Horizon Bank Visa Credit Card

RewardsIntroductory interest rate. This card offers a 4.99% p.a. interest rate on purchases and balance transfers for the first 5 months from card approval. At the end of the promotional period, any unpaid balances will accrue interest at the standard rate of 12.95% p.a.No annual fee. The Horizon BaMaurices Credit Card >>

A common sight in malls across the country, Maurices is a women's clothing retailer with a long history of providing small towns with big fashion. The brand was established in the city of Duluth, Minnesota in 1931, and has since expanded into over 1,000 stores in the US and Canada. Maurices is perhaps best known for its wide range of clothing sizes, providing affordable fashion in sizes from 0 to 26.

Maurices Credit Card

Frequent Maurices shoppers could save a considerable amount of money with the mymaurices VIP credit card, but its exceptionally high APR means those who don’t usually pay their balances in full every month should stay far, far away.Maurices Credit Card Review

Full ReviewWhile the mymaurices VIP Credit Card's 27.99% APR is almost competitive for a store card (or a subprime one), it's barely in the range for your typical prime credit card. It also makes carrying a balance on your mymaurices card a big no-no. On the bright side, the mymaurices VIP CHow to Apply For Maurices Credit Card

OnlineSearch for the official websiteFollow the requirement and entry the needed messages.Meijer Credit Card >>

Meijer Inc. is an American supercenter chain throughout the Midwest, with its corporate headquarters in Walker, Michigan, which is a part of the Grand Rapids metropolitan area.[3][4] Founded in 1934 as a supermarket chain, Meijer is credited with pioneering the modern supercenter concept in 1962. About half of the company's 253 stores are located in Michigan, with the other half in Illinois, Indiana, Kentucky, Ohio, and Wisconsin.

Meijer Mastercard Credit Card Payment

You can pay your Meijer Credit Card online, using CheckFree or in any Meijer store with cash or personal check.Another option is to do it via mail. In case you opt for this, make sure your payment is received on time. That means to send it at least 5 days prior the due date. The address is: Meijer,How to Get the Most Out of Meijer Mastercard Credit Card

Whether you use the Meijer credit card outside of gas stations purchases will depend on one major factor: whether you already own a general cash back rewards card that offers at least 1.3% cash back. The reason being that cash back bonus greater than 1.3% will yield a greater reward than Meijer’sHow to Apply For Meijer Mastercard Credit Card

Apply onlineFollow the link to apply. To apply for Meijer credit cards, you must be of age, have a valid photo ID (government-issued), a government-issued tax identification number and a valid mailing address.Menards >>

Menards is a chain of home improvement stores located in the Midwestern United States, owned by founder John Menard Jr. through his privately held company, Menard, Inc. Menards® home improvement stores are conveniently located throughout the Midwest in a 14-state region. From the novice do-it-yourselfer to the experienced contractor, Menards® has something for everyone! As a family-owned and operated business, Menards® is truly dedicated to service and quality and is the place to "Save BIG Money!®" on all your home improvement needs.

Apply for Menards Credit Card

In fact, the entire application process takes around 10 minutes, so you won’t have to spend a lot of time on it. So, just follow our guidelines below and apply for this credit card.In the first place, you should open the website of this credit card: https://www.menards.com/main/credit-services/c-3Menards BIG Credit Card

Menards has been one of the leading stores for home improvements for over five decades now. Many people rely on this store for their home improvement needs where they spend thousands of dollars. The Menards Big Card is designed to help all the Menards loyalists to get more rewards from making their purchases in the store and a few other selected gas stations. The card offers different types of rewards from cash back to in-store financing making it a very valuable tool especially if you tend to do a lot of home improvement.How to Get the Most Out of Menards Big Card

HowBecause of the card’s high APR, opt for deferred-interest financing over the everyday rebate if you’ll need more than a month to pay off a purchase.That being said, beware of deferred interest associated with the card’s special financing offers. Interest is imposed retroactively if you stilMilestone Mastercard >>

The Milestone Gold Mastercard from The Bank of Missouri is an unsecured credit card designed to help you build or rebuild your credit history. Depending on your credit situation and how you use the card, however, it could get expensive.Requiring no security deposit, the Milestone Gold Mastercard is among a few cards that allow those with bad credit or no credit at all to get credit without having to put down money. Its minimum credit limit is $300 and its annual fee can be as high as $99.

Milestone Gold Mastercard

The Milestone Gold Mastercard from The Bank of Missouri is an unsecured credit card designed to help you build or rebuild your credit history. Depending on your credit situation and how you use the card, however, it could get expensive.How to Apply For Milestone Gold Mastercard

OnlineTo apply now for the Milestone Gold card, head over to the official website. You can securely input all of the required information in order to check your prequalification status before applying for the card!By prequalifying first, you can check whether or not you are likely to be approved forMilestone Gold Mastercard Review

Full ReviewThe Milestone Credit Card is an unsecured card for people with credit scores below 640. The Milestone Card has a $0 security deposit requirement and offers a $300 credit limit, with an annual fee of $35 - $75 the first year. That could make some emergency expenses a bit easier to handle,Overstock Store Card >>

The Overstock Store Credit Card is a good option for those people who frequently shop at Overstock.com and are looking to receive rewards for their spending. This card doesn’t have an annual fee, allows you to get free interest (for a set time period) on your spending, and comes with some cardholder rewards.

Overstock Store Credit Card

The Overstock Store Credit Card is a good option for those people who frequently shop at Overstock.com and are looking to receive rewards for their spending. This card doesn’t have an annual fee, allows you to get free interest (for a set time period) on your spending, and comes with some cardholder rewards.Overstock Store Credit Card Review

Full ReviewOnly one option left. There used to be two Overstock.com credit cards: this Overstock.com Store Card and the Overstock Mastercard. The Overstock Mastercard has been discontinued and only the store card is available right now. You only need fair credit to get approved for the store card, wHow to Apply For Overstock Store Credit Card

OnlineApplying for the Overstock Store card is simple; just head over to the Overstock website.If you want to potentially avoid a hard credit inquiry, you can also try the “shopping cart trick.” This means that a credit card offer from Comenity Bank may pop up with an incentive to apply as you aPNC Credit Card >>

PNC Financial Services Group, Inc. (stylized as PNC) is an American bank holding company and financial services corporation based in Pittsburgh, Pennsylvania. Its banking subsidiary, PNC Bank, operates in 21 states and the District of Columbia with 2,459 branches and 9,051 ATMs. The company also provides financial services such as asset management, wealth management, estate planning, loan servicing, and information processing.

PNC points Visa Credit Card Review

Pros ExplainedOne rewards rate on all purchases: Some credit cards have a tiered program that offers different rewards rates on different types of purchases. Some even cap how much you can earn in these categories. With this card, you can avoid keeping track of all that, and you’ll earn a more prePNC points Visa Credit Card

The PNC points Visa Credit Card makes it easy to earn a lot of rewards points, but they’re worth so little that most people are better off with any number of other cash-back cards on the market. The one way to get a decent value is to maintain a big balance in a qualifying PNC checking account.Who Is PNC points Visa Credit Card Best For?

At first glance, the PNC points Visa Credit Card has a pretty impressive rewards rate: 4 points for every $1 you spend, and even more if you are an eligible PNC banking customer.But PNC points are worth a fraction of a penny each, so for most people, the rewards are quite meager. In fact, 4 points pSears Credit Card >>

Sears offers two consumer credit cards for the typical customer: the Sears Card® and the Shop Your Way Mastercard®. These cards are designed for people who shop at Sears quite a bit, and often spend a lot of money there.

Should you get a Sears credit card?

Both Sears credit card options suffer from the same afflictions as most store cards: high interest rates and restrictive rewards.Let’s start with interestWith either card, the APR for purchases and balance transfers is 27.24% variable. That’s much higher than the average rate on credit card accoSears Credit Card

If you shop at the same store frequently — once a month or more — it could potentially be worthwhile to get that store’s dedicated credit card, if its discounts and rewards are useful to you.But even frequent Sears shoppers might want to skip the retail chain’s branded credit cards and opt instead for a general-purpose rewards card.Here’s why, plus some other things to keep in mind about Sears credit cards.Sears Credit Card Payment

You can make a Sears Credit Card payment online, by phone, by mail, or in person at a Sears location. Making a payment online is the easiest way. To pay your Sears Credit Card bill online, go to the Sears card payment page, log into your account, navigate to the payment section, and enter yourShell Co-Branded Credit Card >>

Shell credit cards offer rewards for your purchases at Shell and provide a more secure way to do your shopping. Filling up has never been so rewarding! Shell is the number one global lubricant supplier, delivering market-leading lubricants to consumers in over 100 countries. Shell Lubricants brings world-class technological insights to its products, offering you the best formulations for your vehicle.

Shell Fuel Rewards Card

If you’re a regular at Shell stations and don’t have the best credit, the Shell Fuel Rewards Card may be a good way to save some money each time you’re at the pump with immediate savings—no waiting for rebates.Shell Fleet Plus Credit Card

The Shell Fleet Plus Credit Card is a charge card, designed to be issued to a fleet of drivers, letting them purchase gas and supplies at Shell and participating Jiffy Lube locations. You'll get a 15% discount at Jiffy Lube for oil changes and preventative service.Who Is Shell Fuel Rewards Card Best For?

If you’re a regular Shell customer with imperfect credit, the Shell Fuel Rewards Card may be a good choice for saving a couple of bucks every time you gas up. You’ll get an instant discount of 10-cent per-gallon at the pump as long as you maintain Gold-level Fuel Rewards membership status. Plus,SunTrust Credit Card >>

SunTrust Banks, Inc. was an American bank holding company with SunTrust Bank as its largest subsidiary and assets of US$199 billion as of March 31, 2018.The bank's most direct corporate parent was established in 1891 in Atlanta, where it was headquartered.The SunTrust Secured Card isn’t as flashy or well-known as the secured cards from some of the major card issuers. Still, we think this card is worth taking a second glance at because, unlike most other secured cards, it offers rewards for your spending and you’ll even earn interest on your security deposit.

SunTrust Secured Credit Card

The SunTrust Secured Card isn’t as flashy or well-known as the secured cards from some of the major card issuers. Still, we think this card is worth taking a second glance at because, unlike most other secured cards, it offers rewards for your spending and you’ll even earn interest on your security deposit.SunTrust Secured Credit Card Review

Details of prosOffers rewards: It’s relatively rare to see a secured card that offers rewards, especially in such useful areas as gas and groceries. Chances are, if you spend a fair amount in these areas, you can earn more in rewards than you pay for the annual fee.At least a 10% rewards bonus forWho Is SunTrust Secured Credit Card Best For?

We recommend this card if you’d like to try your hand at earning cash-back rewards while building your credit. After all, there are very few secured cards out there that also offer rewards. And, when you close the card and get your deposit back, SunTrust will pay you interest on your deposit—somTD Bank Credit Card >>

TD Bank, N.A., is an American national bank and subsidiary of the Canadian multinational Toronto-Dominion Bank. It operates primarily across the East Coast, in fifteen U.S. states and Washington, D.C. TD Bank is the seventh-largest U.S. bank by deposits and the 8th largest bank in the United States by total assets, resulting from many mergers and acquisitions. T.D. Bank, N.A. is headquartered in Cherry Hill, New Jersey.

TD Bank Cash Credit Card

The TD Cash Card from TD Bank is a quality cash-back card geared toward foodies and grocery shoppers. The rewards-earning rates and sign-up bonus is on par with similar cards that also don’t have an annual fee, making the TD Cash Card a worthy option for your wallet—if you can apply. Unfortunately, this card is only offered in certain parts of the United States.TD Bank Cash Credit Card Review

The Details of ProsEasy-to-earn sign-up bonus: The current offer isn’t the best you can get from a no-annual-fee cash-back card right now, but we like that it’s easy to earn. You only have to spend $167 per month for three months after opening your account to put $150 back in your wallet as a siWho Is TD Bank Cash Credit Card Best For?

If you find that a lot of your credit card spending is done at restaurants or supermarkets, and you want to earn some cash back, this card could be a great fit for you. The TD Cash Card works like most cash-back credit cards in that it’s simple to earn and redeem rewards.the First Access Visa Credit Card >>

The First Access Visa® Card is a credit card perfect for helping people with poor credit repair their scores. Because you have poor credit, expect to pay high interest rates and fees in exchange for the opportunity to show you can manage your credit and payments.

First Access Visa® Card

The First Access Visa® Card is a credit card perfect for helping people with poor credit repair their scores. Because you have poor credit, expect to pay high interest rates and fees in exchange for the opportunity to show you can manage your credit and payments.How to Apply For First Access Visa® Card

OnlineYou can fill out a First Access card application on the First Access website. There is no way to apply over the phone or via mail. To apply for the First Access card, you need to be at least 18 years old – and to get approved, you will need to have a checking or savings account. You’ll alsFirst Access Visa® Card Review

ReviewThe First Access Visa is an unsecured credit card for people with bad credit. It is quite expensive, charging a one-time fee of $95* before account opening, followed by a $75 annual fee the first year and a combination of annual and monthly fees totaling $123 per year after that. The First AccTires Plus Credit Card >>

The Tires Plus Credit Card is perfect for those who put a lot of miles on their vehicles and need to regular service their car or truck. Tires Plus offers a no-interest-paid promotion in the case that a $299 minimum purchase is paid off in full within 6 months.

Tires Plus Credit Card

The Tires Plus Credit Card is perfect for those who put a lot of miles on their vehicles and need to regular service their car or truck. Tires Plus offers a no-interest-paid promotion in the case that a $299 minimum purchase is paid off in full within 6 months.How to Get Most Out of Tires Plus Credit Card

Owning a car takes a lot of responsibility and Tires Plus card help you make sure these responsibilities are all covered. We all know there are a lot of things to consider when purchasing one. For your car to last and keep its mileage at par, you have to develop a habit of taking care of its maintenTires Plus Credit Card Review

Tires Plus Card is Honored Nationwide!This means that when you get stuck out of nowhere, you’ll still be able to claim your privileges as a Tires Plus card owner. It wouldn’t be too much of a big deal for you if you suddenly need your car repaired – as long as you have contacted the nearest ouTorrid Credit Card >>

A popular plus-size apparel company, Torrid started as a subset of Hot Topic, a retailer specializing in "counterculture" apparel and accessories. While Torrid originally mimicked Hot Topic's alternative styles, it later branched out from the edgier retailer, becoming its own LLC in 2015. The new Torrid offers a wide range of more mainstream clothing styles for women and girls in sizes 10 to 30, with over 400 stores across the US.

How to Apply For Torrid Credit Card

OnlineVisit the Torrid Insider Credit Card website.Fill in the application form. You will typically need to provide general financial information, such as your Social Security Number, address, and annual income.Check the information is accurate and submit your application.If you're denied clickTorrid Credit Card

Like many popular retailers, Torrid offers a closed-loop consumer credit card for those who want to save a little on their branded purchases. Unlike most other store credit cards, however, the Torrid Insider Credit Card is a little light on the rewards, good only for the occasional coupon or special offer. And while the card doesn't have an annual fee, the high APR makes it a questionable addition to your wallet.Torrid Credit Card Review

Full ReviewNice initial discount. You will receive 25% off your first online purchase with the Torrid Credit Card, which could save you a bundle if you time things right. This isn't the biggest first-purchase discount available from a store card but it's still a great deal if you're planUlta Credit Card >>

If you frequently purchase makeup, perfume, hair care products and other cosmetics from Ulta Beauty store, it may be worthwhile to consider opening an Ultamate Rewards® Credit Card.In addition to receiving a special discount on your first purchase, the card lets you earn rewards on all your Ulta Beauty purchases, which can be redeemed for merchandise at Ulta Beauty.

Ultamate Rewards® Mastercard® Credit Card

This store-branded card earns rewards when you shop at not just Neiman Marcus, but also Bergdorf Goodman, Last Call, and Horchow, for no annual fee. If you spend at least $1,000 in a year you can take advantage of free two-day shipping for online orders.Ultamate Rewards® Mastercard® Credit Card Review

Full ReviewThe Ulta Credit Card is a $0 annual fee rewards credit card for people who want to save money on Ulta Beauty products and services. It offers 20% off your first Ulta purchase made with the card, plus ongoing rewards of 2 points per $1 spent at Ulta. The Mastercard version of the Ulta CredHow to Apply For Ultamate Rewards® Mastercard® Credit Card

OnlineVisit Ulta.com and find the Ultamate Rewards Credit Card at the bottom of the page.Click the link and then click Apply now.Fill out the application form.Review the form and submit.USAA Credit Card >>

The United Services Automobile Association (USAA) is a San Antonio-based Fortune 500 diversified financial services group of companies including a Texas Department of Insurance-regulated reciprocal inter-insurance exchange and subsidiaries offering banking, investing, and insurance to people and families who serve, or served, in the United States Armed Forces. At the end of 2017, it had 12.4 million members.

USAA® Preferred Cash Rewards Visa Signature® Card

The USAA Preferred Cash Rewards Visa Signature card is geared toward military members and their families who want a simple, no-fuss cash-back rewards card. However, the card lacks some important features you typically find with other cash-back rewards cards.USAA Rewards American Express Card

The USAA Rewards American Express Card offers active-duty service members, veterans, and certain family members the chance to earn points on everyday purchases that they can use for a wide range of redemption options. But given that its points system is opaque to non-cardholders, you’ll probably be better off with another card if you have a specific type of reward in mind.USAA Preferred Cash Rewards Visa Signature Card

If you’re a USAA member or eligible for membership, you might be tempted by the USAA Rewards Visa Signature Card if you’re looking to earn rewards on your everyday purchases. And indeed—you can redeem your rewards points for a wide range of items, from gift cards to statement credits. Unfortunately, this card doesn’t earn points as rapidly as some other rewards cards do.Value City Credit Card >>

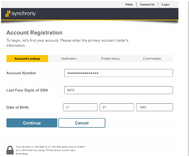

Synchrony Bank is a major issuer of retail and co-branded credit cards, including big names like Amazon, PayPal, and Lowe’s. It also issues specific credit cards to be used across a variety of healthcare services, auto shops, and home furnishing stores.Despite all the different card offers, you can use the basic Synchrony Bank login page at MySynchrony.com to access any Synchrony card account. Or you can download the MySynchrony app for your smartphone. You’ll be able to check your card details and pay bills with either method.

Value City Furniture Credit Card

Value City Furniture Credit Card is a store credit card issued by Synchrony Bank. If you're wondering whether Value City Furniture Credit Card is the right card for you, read on. This is everything you need to know to make a good choice.How to Apply For Value City Furniture Credit Card

OnlineIf you are keen to apply for the Value City Furniture Credit Card, simply click on the "Apply Now" button below to be taken to the credit card official website to complete the credit card application form. Our website will not record any personal information about you, and the wholeValue City Furniture Credit Card Payment

OnlineStart by visiting Synchrony's credit card support site. Search for the store your card is co-branded with, or for your credit card type. You'll be given a link to access your account online, along with a phone number to call if you need it.Yamaha Credit Card >>

The Yamaha card is somewhat a hybrid credit account. It creates an open line of purchase yet a Yamaha bike bought with the HSB Yamaha credit card is considered security for the debt.Most economists describe credit cards as unsecured debt unlike auto loans and mortgages. The private label credit cards are designed to encourage purchases of the product of a specific brand name and facilities that purchase by providing financing.

Yamaha Credit Card

The Yamaha card is somewhat a hybrid credit account. It creates an open line of purchase yet a Yamaha bike bought with the HSB Yamaha credit card is considered security for the debt.Most economists describe credit cards as unsecured debt unlike auto loans and mortgages. The private label credit cards are designed to encourage purchases of the product of a specific brand name and facilities that purchase by providing financing.How to Get Most Out of Yamaha Credit Card

If you obtain a loan to buy a specific motorcycle or car, the loan terms are clearly spelled out before you sign. The interest rate is given and is good for the life of the loan. Any fees are incurred when the loan is obtained and only late fees might add to that total should you not make payments iYamaha Credit Card Review

The Yamaha card is somewhat a hybrid credit account. It creates an open line of purchase yet a Yamaha bike bought with the HSB Yamaha credit card is considered security for the debt.Most economists describe credit cards as unsecured debt unlike auto loans and mortgages. The private label credit cardHome Depot Credit Cards >>

The Home Depot Consumer Credit Card, issued by Citi, is a store credit card exclusively for Home Depot purchases. Considering that this card offers an array of special financing offers, it can help you save money on interest if you need a few months to pay off your purchases.

Home Depot Credit Card

The Home Depot Consumer Credit Card, issued by Citi, is a store credit card exclusively for Home Depot purchases.Home Depot Credit Card Application

Home Depot Credit Card Application Online1.To get started, visit website at homedepot.com/applynow.2.Click on “Credit Services” at the top of the page.3.Scroll down to the Consumer Credit card area and click “Apply Now” to apply for Home Depot card4.Enter your first and last name, your emailHome Depot Credit Card Payment

The Home Depot Consumer Credit Card, issued by Citi, is a store credit card exclusively for Home Depot purchases. Considering that this card offers an array of special financing offers, it can help you save money on interest if you need a few months to pay off your purchases.Mlife Credit Card >>

Fans of MGM Resorts and casinos will be lining up to apply for the M life® Rewards Mastercard®, which allows you to turn everyday purchases into M life Rewards Points that can be redeemed for use on hotel room stays, dining and entertainment at participating M life Resorts. Earn up to 3x points and Tier Credits for every dollar you spend with your card, and enjoy an introductory bonus of 10,000 points when you make qualifying purchases. Use this card to earn rewards towards your next Vegas trip – it certainly won’t be at odds with your wallet.

How to Apply For Mlife Credit Card

OnlineIn the first place, you have to open a new tab in the browser and click on the "APPLY HERE" button.On the webpage you have just got to see, you should click on the "APPLY NOW" button, placed on the right side.Following it, you will get to see the application form. Start filMlife Credit Card

Fans of MGM Resorts and casinos will be lining up to apply for the M life® Rewards Mastercard®, which allows you to turn everyday purchases into M life Rewards Points that can be redeemed for use on hotel room stays, dining and entertainment at participating M life Resorts. Earn up to 3x points and Tier Credits for every dollar you spend with your card, and enjoy an introductory bonus of 10,000 points when you make qualifying purchases. Use this card to earn rewards towards your next Vegas trip – it certainly won’t be at odds with your wallet.Mlife Credit Card Review

Full ReviewMlife Rewards credit card appears to be a hotel credit card from MGM, an American chain of hotels. As a matter of fact, this credit card can boast to have pretty decent rewards, and it may be lucrative for you to get this credit card if you tend to stay at Mlife resorts. But let's conNFL Credit Card >>

The NFL Extra Points Credit Card,is issued by Barclays, kicks off with certain benefits that die-hard fans might find valuable, including double rewards on merchandise, a 0% introductory APR offer on game tickets, and a sign-up bonus that could cover the cost of some tailgating.

NFL Extra Points Credit Card

The NFL Extra Points Credit Card, issued by Barclays, kicks off with certain benefits that die-hard fans might find valuable, including double rewards on merchandise, a 0% introductory APR offer on game tickets, and a sign-up bonus that could cover the cost of some tailgating.NFL Extra Points Credit Card Review

Full ReviewThe NFL Extra Points Credit Card, issued by Barclays, kicks off with certain benefits that die-hard fans might find valuable, including double rewards on merchandise, a 0% introductory APR offer on game tickets, and a sign-up bonus that could cover the cost of some tailgating.BarclaycardHow to Apply For NFL Extra Points Credit Card

OnlineSearch for the official websiteFollow the requirement and entry the needed messages.Roaman's Credit Card >>

Roaman’s is a store chain committed to finding plus-size women the very best in fashion while not compromising on quality. They have everything from bras to outerwear to simple everyday business attire. Getting a Roaman’s credit card is the first step in finding fashion that fits, and being able to shop when you need to without worrying about money.

Roaman's Credit Card

Roaman’s is a store chain committed to finding plus-size women the very best in fashion while not compromising on quality. They have everything from bras to outerwear to simple everyday business attire. Getting a Roaman’s credit card is the first step in finding fashion that fits, and being able to shop when you need to without worrying about money.How to Get Most Out of Roaman's Credit Card

Adding another year is a positive thing in the world of Roaman’s. To help you celebrate your birthday, they give you a 20% discount on virtually anything in the store every year you are a card member and your account is in good standing.Roaman’s extend the birthday celebration to the entire montRoaman's Credit Card Review

No annual fee.One of the most important features of a store card is the no annual fee. The reason for this is because as store card interest rates tend to be a bit higher than standard bank cards, every dollar you pay for an annual fee bumps up the APR a little. The result is you find your credit li76 Credit Card >>

76 is a Phillips 66 owned company which operates a chain of fuel stations in the US. They are a highly successful and well-known gas station company, and they offer personal credit cards which offer plenty of rewards potential, plus commercial and fleet cards to help businesses save more money on gas purchases.

76 Credit Card

76 is a Phillips 66 owned company which operates a chain of fuel stations in the US. They are a highly successful and well-known gas station company, and they offer personal credit cards which offer plenty of rewards potential, plus commercial and fleet cards to help businesses save more money on gas purchases.How to Get Most Out of 76 Credit Card

For the 76 Personal credit card you gain a saving of 5 cents per gallon, which applies for up to 110 gallons purchases in each billing cycle. This saving (0.5 cents multiplied by the amount you purchase) will be automatically credited to your account. You must spend at least 45 gallons for the credi76 Credit Card Review

Full Review76 is a Phillips 66 owned company which operates a chain of fuel stations in the US. They are a highly successful and well-known gas station company, and they offer personal credit cards which offer plenty of rewards potential, plus commercial and fleet cards to help businesses save moreAAA Credit Card >>

Whether or not you are an AAA member, the AAA Member Rewards Credit Card is an excellent option for your wallet. It provides a 3% rewards rate on travel purchases, and 2% at gas stations, grocery stores, and drugstores. All of these are well above what the average cash back credit cards provide in similar categories. Though you can get comparable rewards with a better welcome bonus with other cards, those offers typically come with annual fees and bonus-requirements that require you to be a high-spender to turn a profit.

AAA Dollars® Mastercard®

You’ll need a AAA membership to apply for this card, and depending on your zip code, this card may not be available to you or you may get a different offer. You can take advantage of a 40% bonus when you redeem your points for AAA gift cards, as well as a long 0% intro APR period for purchases and balance transfers.How to Apply For AAA Credit Card

OnlineThe only way to fill out a AAA Credit Card application is online. There is no way to apply over the phone or in-person, but applying online is easy. Just provide your AAA Membership ID, full name, mailing address, Social Security number, and other personal info. After you submit yourAAA Dollars® Plus Mastercard

A AAA membership is required to apply for this card, and depending on where you live, this card may not be available to you or you may receive a different offer. You’ll get a long 0% intro APR period for purchases and balance transfers, and you can get up to a 40% bonus when you redeem your points for AAA gift cards.AARP Credit Card >>

The AARP Credit Card from Chase offers a great combination of high-value rewards with minimal ongoing costs, as long as you pay your bill on time and in full. Frequent diners may find this card especially attractive given the rewards on restaurant spending and the charity donation Chase makes on those purchases.

The Rewards of AARP Credit Card

RewardsThere's a decent amount of flexibility in using the points you earn with the AARP card. Here are your options:Cash: Get cash direct deposited into your checking or savings account, or applied as a statement credit. A point has a value of 1 cent when redeemed for cash back. AARP membeAARP Credit Card

The AARP Credit Card from Chase offers a great combination of high-value rewards with minimal ongoing costs, as long as you pay your bill on time and in full. Frequent diners may find this card especially attractive given the rewards on restaurant spending and the charity donation Chase makes on those purchases.AARP Credit Card Review

Details of prosLow fees: Not only does this card have no annual fee, it also has lower late fees than most cards. Whereas some cards charge up to the maximum threshold allowed by the federal government (up to $29 the first time you're late, or up to $40 if you've been late on your payment moABC Warehouse Credit Card >>

ABC Warehouse is a chain of retail stores, specializing in appliances and electronics in the USA. They offer the credit card facility to their customers, issued by Synchrony Bank. Electronics and home furnishing store ABC Warehouse has partnered with Synchrony Bank to offer credit card to its customers. The credit card not only comes with special financing option, but it also offers the cardholders a complete online solution. Cardholders can pay their shopping bills and get details of the transactions online.

How to Apply For ABC Warehouse Credit Card

OnlineVisit the ABC Warehouse Credit Card website.Fill in the application form. You will typically need to provide general financial information, such as your Social Security Number, address, and annual income.Check the information is accurate and submit your application.How to Get Most Out of ABC Warehouse Credit Card

This store credit card packs a lot of punch; customers can frequently get a signup bonus. Most recently, one could get a statement credit after spending just some dollars on the first day having the card. Cardholders can also get few percent cash back on all of purchases. The store has just about evThe Rewards of ABC Warehouse Credit Card

Currently, this card does not provide any rewards, but as a means of financing, it provides convenience to customers. If you are a loyal customer of ABC Warehouse, then this card can provide you with new shopping methods and promptly notify you of special offers in the store.That can come in handy iAcademy Credit Card >>

Academy Sports + Outdoors is an American sporting goods discount store chain. It has corporate offices in the Katy Distribution Center in unincorporated western Harris County, Texas, United States, near Katy and west of Houston. For 74 years it was a privately held company owned by the Gochman family, until its May 2011 acquisition by Kohlberg Kravis Roberts & Co investment firm.

Academy Sports + Outdoors Credit Card Payment

Academy Credit Card customers can make a payment online or over the phone. To pay your Academy Credit Card bill online, log into your account on Comenity Bank’s Academy portal. Navigate to the “Payments” section and add your bank account and routing number. Then, choose your payment date and pAcademy Sports + Outdoors Credit Card

If you frequently shop at Academy Sports and Outdoors, then this credit card may be a good fit to help you earn extra rewards on your sporting purchases. New cardholders can receive 1,000 bonus points after their first purchase, and $15 off today's in-store purchase when you open a new account. For ongoing rewards, cardholders earn a generous 5 points per dollar spent at Academy Sports and Outdoors, 2 points at gas stations, and 1 point everywhere else. The annual fee is either $0 or $29, based on your credit-worthiness.Academy Sports + Outdoors Credit Card Review

One application, two possibilities. There are two Academy credit cards, but you can’t apply for them separately. Your application will first be considered for the Academy Sports + Outdoors Visa Signature Credit Card. And if you don’t qualify, you’ll be subsequently considered for the Academy SAlaska Airlines Credit Card >>

When you apply for Alaska Airlines Credit Card,Your first year is on us- $0 introductory annual fee the first year, then just $75!Plus, 40,000 bonus miles and Alaska's Famous Companion Fare™ from $121 ($99 plus taxes and fees from just $22). To qualify simply make purchases of $2,000 or more within the first 90 days of opening your account.

Alaska Airlines Credit Card

When you apply for Alaska Airlines Credit Card,Your first year is on us- $0 introductory annual fee the first year, then just $75!Plus, 40,000 bonus miles and Alaska's Famous Companion Fare™ from $121 ($99 plus taxes and fees from just $22). To qualify simply make purchases of $2,000 or more within the first 90 days of opening your account.How to Apply For Alaska Airlines Credit Card

OnlineLog in to the official website of Ainlaska AirlesReview the Important Information and Terms about opening an account prior to submitting your applicationEnter personal information and check the Terms & Conditions.Agree to the terms and conditions.Wait for approvalThe application typicallyThe Rewards of Alaska Airlines Credit Card

RewardsGet 40,000 bonus miles plus Alaska's Famous Companion Fare™ from $121 ($99 fare plus taxes and fees from just $22) after you make purchases of $2,000 or more within the first 90 days of opening your account.Every year on your account anniversary get another companion fare from $121 ($99Ally CashBack Credit Card >>

The Ally CashBack Credit Card is a new credit card with good returns on gas and grocery spending. It also comes with a 10% bonus for those who deposit their rewards to an eligible Ally Financial bank account. Even with this boost, however, the card won’t give you the same returns we’ve come to expect from the best credit cards.The Ally CashBack Credit Card is a decent choice for those who spend heavily on gas and groceries. If you are an optimizer who wishes to get bigger savings, we suggest looking at other options.

Ally CashBack Credit Card Review

Full ReviewThe Ally CashBack Credit Card is a solid everyday credit card, especially for those who already have an account with the bank. The card gives a 2% cash back rate at grocery stores and gas stations, and 2.2% if you deposit your rewards into an Ally account. These rates are well above averaAlly CashBack Credit Card

The Ally CashBack Credit Card is a new credit card with good returns on gas and grocery spending. It also comes with a 10% bonus for those who deposit their rewards to an eligible Ally Financial bank account. Even with this boost, however, the card won’t give you the same returns we’ve come to expect from the best credit cards.The Ally CashBack Credit Card is a decent choice for those who spend heavily on gas and groceries. If you are an optimizer who wishes to get bigger savings, we suggest looking at other options.How to Get Most Out of Ally CashBack Credit Card

The Ally CashBack Credit Card gives users a 2% return on their gas and grocery spending, and 1% back on all other purchases. You also get a 10% bonus if you deposit your awards into an eligible Ally Financial account -- these include money market, non-IRA online savings, and interest checking accounAmerican Express Credit Card >>

The American Express Company (Amex) is an American multinational financial services corporation headquartered at 200 Vesey Street in New York City. The company was founded in 1850 and is one of the 30 components of the Dow Jones Industrial Average.The company is best known for its charge card, credit card, and traveler's cheque businesses.

The Rewards of American Express Blue Cash Everyday Card

RewardsEarn a $200 statement credit after you spend $1,000 in purchases on your new Card within the first 3 months.3% Cash Back at U.S. supermarkets (on up to $6,000 per year in purchases, then 1%).2% Cash Back at U.S. gas stations and at select U.S. department stores.1% Cash Back on other purchasesAmerican Express Blue Cash Everyday Card

The American Express Blue Cash Everyday Card makes it easy to earn cash back where you spend the most, thanks to its especially lucrative rewards rate at supermarkets, gas stations, and select department stores. All for no annual fee.American Express Blue Cash Everyday Card Review

Full ReviewThe American Express Blue Cash Everyday Card is a good all-around credit card for people with 700+ credit scores. Amex Blue Cash Everyday has a $0 annual fee and offers a 0% introductory APR on purchases, a $200 statement credit for spending $1,000 in the first 3 months, and bonus cash baAmerican Airlines AAdvantage® Aviator™ Silver Credit Card >>